Negative returns from real estate have caused Ontario Teachers’ Pension Plan to underperform its real assets benchmarks in 2024, despite strong returns from infrastructure.

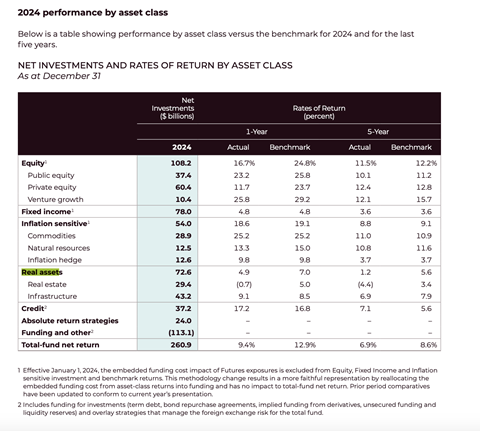

The Canadian pension fund’s C$72.6bn (€46.7bn) real assets portfolio returned 4.9% over 12 months and 1.2% over five years, below its benchmarks of 7% and 5.6%, respectively. Strong performance in infrastructure was not enough to offset the negative returns from real estate.

The C$29.4bn real estate portfolio returned -0.7% for the year ending 31 December 2024, compared with the benchmark’s 5%, an underperformance “largely attributable to the overconcentration of the portfolio in sectors with weaker relative performance, particularly office”, Ontario Teachers’ said.

Meanwhile, infrastructure generated a 9.1% return, exceeding the benchmark’s 8.5%. Ontario Teachers’ attributed the infrastructure portfolio’s performance mainly to “strong performance in certain transportation sub-sectors, electricity transmission and digital infrastructure assets”.

Over five years, real estate chalked up a return of -4.4% – versus its benchmark of 3.4% – while infrastructure returned 6.9%, also below its 7.9% benchmark.

The pension fund’s C$43.2bn global infrastructure assets include investments in toll roads, airports, digital infrastructure, container terminals, power generation, electricity distribution and transmission, gas distribution and transmission and water distribution and wastewater plants.

Ontario Teachers’ held the eighth position in the 91��ý���� Top 100 infrastructure investors 2024 rankings and 27th in the Top 150 Real Estate Investors 2024 rankings.

The pension fund’s C$12.5bn natural resources portfolio, which includes investments in agriculture, aquaculture, timberland, natural-climate solutions, metals and oil and gas, posted a 13.3% return during the period, compared with the benchmark’s 15%.

The pension fund’s natural capital portfolio, which excludes metals and oil and gas investments, held the number four position in the 91��ý���� Top 50 natural capital investors 2025.

Overall, the C$266bn pension fund recorded a one-year total-fund net return of 9.4% compared with its benchmark of 12.9%. The underperformance was primarily attributed to private equity and real estate, Ontario Teachers’ said.

To read the latest 91��ý���� magazine click here.