Blackstone Real Estate Debt Strategies has secured £260m (€305.7m) in financing for a 1m sqft UK logistics portfolio of 14 assets owned by Valor Real Estate Partners and QuadReal Property.

The partnership between Valor and QuadReal has refinanced the VIQR 1 London Urban Logistics Portfolio of urban logistics and light industrial assets.

Stefano Tomaselli, managing director at Blackstone, said: “We are extremely pleased to continue to grow our lending relationship with Valor and QuadReal against this high-quality, last-mile portfolio.

“Our ability to underwrite large portfolios efficiently while providing certainty of execution throughout market cycles allows us to consistently deliver for our borrowers.”

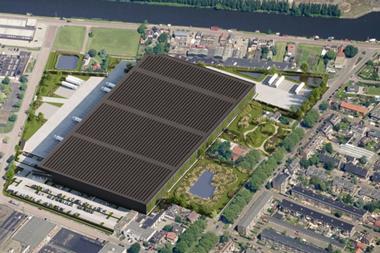

Matthew Phillips, partner and head of finance at Valor, said: “This portfolio is arguably the best demonstration of our ability to acquire underutilised assets in the most supply-constrained locations and transform them into high-quality, future-proof logistics facilities that meet the evolving needs of occupiers.

“Leveraging our vertically integrated management model and hands-on asset management team has enabled us to attract and retain a broad range of businesses for whom proximity to consumers and operational efficiency is critical.

“The facility represents our largest refinancing to date and provides us with significant firepower to continue executing on our strategy.”

Thomas Blangy, senior VP at QuadReal Property, said: “This successful refinancing is testament to the strength of our London urban logistics portfolio, and represents an important milestone in the execution of our global investment strategy. The 14 assets are not only well-located, they represent the benchmark for ESG-led urban logistics.”

In November 2020, European urban logistics investor Valor and QuadReal Property formed a joint venture to invest €1bn in urban logistics assets located in key UK, French and German cities.

At the time, the companies said QuadReal Property, the real estate arm of British Columbia Investment Management Corporation, would be the majority investor in the partnership, which had initial capital commitments of €440m.

With leverage, the value-add and develop-to-hold investment platform was expected to have more than €1bn of investable capital.

In January 2022, the pair launched a second value-add and development venture with a plan to invest an additional €3bn.

“Together with Valor, we have built a high-quality portfolio of industrial and logistics assets across the UK and Europe, all in line with our strategy of targeting major logistics hubs in key target markets, and this transaction will help us to grow our presence in London further,” Blangy added.

To read the latest 91��ý���� magazine click here.