Copenhagen Infrastructure Partners’ latest fund is among a series of infrastructure investment programmes and projects to be guaranteed by the European Union.

Copenhagen Infrastructure II, , is one of eight entities to be given a guarantee under the €350bn European Fund for Strategic Investments (EFSI) scheme, which will be active by “early autumn”, the European Commission said.

EFSI, part of EC President Jean-Claude Juncker’s mobilising Investment Plan for Europe, will guarantee the Abengoa research, development and innovation II project, energy efficiency in residential buildings, Grifols Bioscience R&D, Äänekoski bio-product mill, Redexis Gas Transmission and Distribution, the Arvedi Modernisation Programme and PPP primary healthcare centres in Ireland.

PensionDanmark invested DKK4bn (€536m) in Copenhagen Infrastructure II, which has a total commitment of DKK14.7bn and is investing in large energy-related, including offshore wind, biomass and transmission schemes through mezzanine and equity investments.

Lægernes Pensionskasse, PBU, ��Ø��, DIP, Nykredit, PFA and Nordea invested in the fund. The funds have since been followed by Norway’s Oslo Pensjonsforsikring and Kommunal Landspensjonskasse, Lærernes Pension, AP Pension, SEB Pension and SEB Pension och Försäkring. A UK pension fund managed by The Townsend Group, Denmark’s T&W Holding and LB Forsikring, as well as Villum Fonden have also made commitments to the fund.

The European Investment Bank (EIB) recently provided equity-type financing of up to €75m to Copenhagen Infrastructure II. The financing was proposed for backing by EFSI.

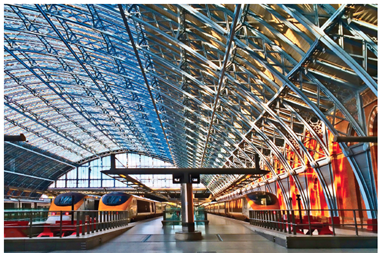

The fund is focusing on energy infrastructure in Northern and Western Europe, as well as in North America. The fund has invested in a biomass power plant in England and two offshore wind projects in Scotland and Germany.

In February, Germany said it would contribute €8bn to the EFSI investment plan through government-owned development bank, KfW. Spain’s Instituto de Crédito Oficial also gave its backing with €1.5bn, as did France’s Caisse des Dépôts and Bpifrance (BPI), with €8bn. Italy’s Cassa Depositi e Prestiti (CDP) contributed €8bn, while the UK has contributed £6bn (€8.5bn). In all, nine member states have so far backed the plan.

Read more on the investment plan .

Topics

- Americas

- Canada

- CEE

- Danish Investors

- DIP

- Europe

- European Commission

- European Investment Bank

- European Investors

- France

- Germany

- Industrial

- Investors

- ����

- Lægernes Pensionskasse

- Nordic Investors

- Norwegian Investors

- Oslo Pensjonsforsikring

- PensionDanmark

- Poland

- Real Estate

- SEB Pension

- Sovereign Wealth Funds

- The Townsend Group

- UK

- US