Climate risk data firm Climate X has raised $18m (€16.8m) in an initial funding round led by Alphabet Inc’s venture capital investment arm, to support its global expansion and develop tools for financial institutions to assess the impact of climate change on physical assets.

The climate risk intelligence company said Google Ventures (GV) led the Series A investment round, which was also backed by Pale Blue Dot, CommerzVentures, A/O, Blue Wire Capital, PT1, Unconventional Ventures and Western Technology Investment.

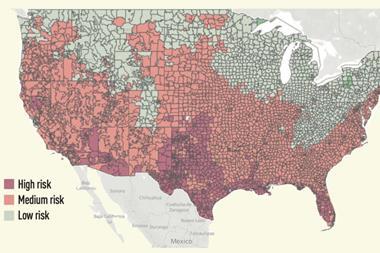

UK-headquartered Climate X offers proprietary financial insights into the likely impact of climate risks on physical asset valuations, from residential and commercial properties to road, rail and power infrastructure.

The firm’s data analytics platform is used by financial institutions and asset managers including Legal & General, , Virgin Money, and Federated Hermes.

Climate X said it will use the new funding to accelerate its expansion in Europe, North America and APAC. The company will also look to “augment its products in line with evolving commercial and regulatory requirements by incorporating additional data sources into its platform”.

Lukky Ahmed, CEO at Climate X, said: “In just over one year since going to market, Climate X has become one of the world’s fastest growing providers of physical climate risk data and analytics, driving value for global financial services clients with over $6.5trn in combined AUM.

“Assessing the impact of physical climate risk on asset valuations and business operations is now a necessity, not a nice-to-have.”

Kamil Kluza, CPO at Climate X, said: “The climate adaptation market will be a vital economic enabler in the years ahead, yet to date, it has been dominated by expensive consultancies reliant on manual human analysis and black box solutions that reduce climate risk to a single rating or score.”

Roni Hiranand, principal at GV, said: “Climate X is a game-changer that accurately quantifies and addresses the impact of climate risk. We’re impressed with Kamil Kluza and Lukky Ahmed’s deep expertise in corporate risk management and believe they have the right skill set to create a next-generation climate risk intelligence product.

“We’re excited to support the Climate X team as they work towards a vision of becoming the backbone for all climate risk-related decision-making within financial organisations.”

Paul Morgenthaler, managing partner at CommerzVentures, said: “With the escalating risk of floods, heatwaves, wildfires, and other climate impacts, physical risks to properties are growing exponentially. Real estate as the world’s largest asset class is increasingly mispriced.

“Climate X provides one of the very few tools to quantify them adequately, while enabling ROI-based adaption for individual properties.”

Heidi Lindvall, general partner at Pale Blue Dot said: “With climate adaptation high on everyone’s agenda, the demand for the most comprehensive tech solution remains more critical than ever.

“Climate X has proven to be the superior choice in this space and, with their deep domain expertise, they are best positioned to successfully serve the financial services market.”

To read the latest 91��ý���� magazine click here.