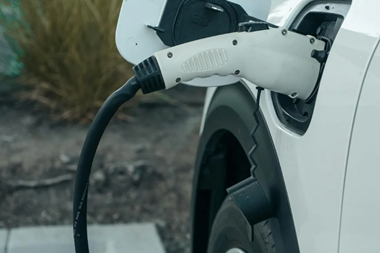

Infracapital, M&G’s infrastructure equity investment arm, is investing in electric vehicle (EV) charging infrastructure via an initial £200m (€196m) investment in energy firm Gridserve.

Gridserve’s existing partners TPG Rise and Mitsubishi HC Capital UK have also increased their shareholding in the company as part of the Infracapital transaction.

Gridserve said its electric highway charging network covers 85% of the UK’s motorway service areas and some of the UK’s busiest retail destinations, adding that Infracapital’s investment will enable it to deliver over 5,000 chargers by 2025.

Toddington Harper, Gridserve’s CEO, said: “Through this investment partnership with Infracapital, we’re excited that our plans can accelerate, and it’s evident we now have the momentum we require.

“They are the perfect partners to join our business as we move to the next level as a company. Their commitment to clean tech, infrastructure, and ESG gives our collective organisations deep-rooted synergies around a shared mission.”

Andy Matthews, the head of greenfield at Infracapital, said: “We are delighted to have invested in Gridserve, as part of our ongoing drive to enable positive change and to make a meaningful contribution to the energy transition while delivering value to our investors.

“Gridserve is leading the charge in the decarbonisation of the UK’s transport system and is led by an experienced management team that has already made great progress in expanding Gridserve’s platform.”

To read the latest edition of the latest 91��ý���� magazine click here.