Real estate investors stand to gain from the global increase in vaccine research companies, according to Savills.

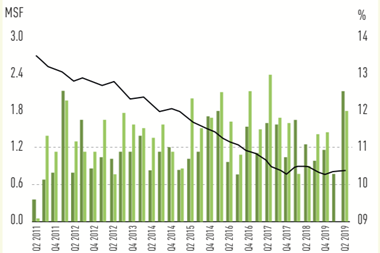

Research published by Savills showed that venture capital (VC) funding into vaccine research companies rose to $2.3bn (€2bn) by the end of August, comprising 1.2% of all global VC investment, up from an annual average of just 0.6% over the past five years.

The US and Germany have been largest recipients of VC investment into vaccine companies this year, while others such as Canada and France have witnessed significant growth in 2020 compared to the preceding five-year period.

The UK and Switzerland saw extremely strong growth between 2015 and 2019 compared to the preceding five-year period.

”For the UK, this growth was 106% and for Switzerland it was 39%, putting them in a robust position for their vaccine-related sectors to continue to expand,” Savills said.

Steve Lang, director in Savills research team, said the period between 2015 and 2019 saw a significant increase in the annual average level of investment for vaccines companies compared to the preceding five-year period in most countries, but unsurprisingly this has now been surpassed by the eight-month total for 2020 given the scale of the pandemic emergency.

“Faster growth in the smaller vaccine-associated companies, which tend to be the main recipients of VC funding, bodes well for developing a strong life science ecosystems, which attracts the global larger corporates, and is good for real estate demand across both the offices and specialist laboratory space sectors.”

Nicky Wightman, director, emerging trends at Savills, said: “In occupational terms, as shown during the lockdown, scientists will always get into the laboratory to work. This more consistent level of occupation, compared to some other sectors, suggests that life science companies generally will have a much higher willingness to maintain or increase their office and laboratory real estate footprint.

“As shown with a substantial rise in the level of funding, this will have a positive impact on the demand for the relevant real estate globally.”

To read the digital edition of the latest 91��ý���� magazine click .